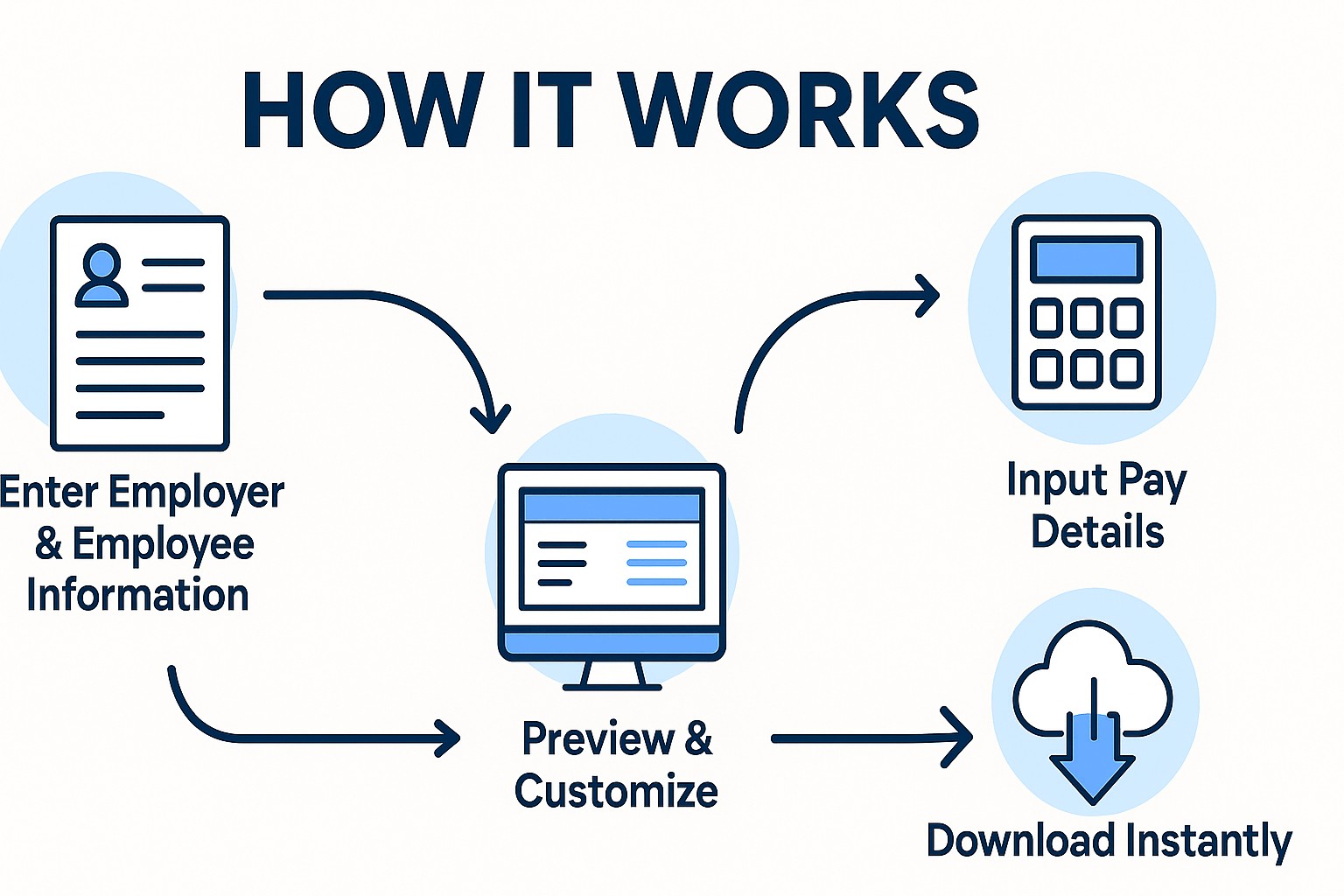

How It Works

Creating professional, CRA-compliant Canadian pay stubs has never been easier. With CanadaPayStubs.com, you can generate and download accurate pay stubs in just a few simple steps — no technical skills required!

Step 1: Enter Employer & Employee Information

- Company Name & Address

- Province of Employment

- Employee Name, Address

- Email Address (for delivery)

Optional features include uploading your company logo and applying tax exemptions if applicable.

Step 2: Input Pay Details

- Pay Type: Hourly or Salary

- Hourly Rate / Annual Salary

- Work Hours & Overtime (if applicable)

- Pay Frequency: Weekly, Biweekly, Monthly, etc.

- Pay Period Start & End Dates

- Pay Date

- Cheque Number (optional)

Our system automatically calculates:

- CPP, EI, Federal & Provincial Taxes

- Net Pay and Year-To-Date values

- Vacation Pay and Other Income (if added)

Step 3: Preview & Customize

Before checkout, you can:

- Preview your paystub in real-time

- Select from multiple professional templates

- Choose pay stub color

- Adjust the number of stubs you want to generate

Step 4: Add to Cart & Checkout

Once satisfied with your stub:

- Click Add to Cart

- Review your selection in the cart

- Apply any coupon codes

- Proceed to secure checkout using:

- Debit/Credit Card

- PayPal

Step 5: Download Instantly

- Your paystub is instantly downloadable

- A copy is also emailed to you in PDF format

- Watermark-free and ready to print or share

Bonus Features

- Re-download your stubs anytime

- Free sample previews

- T4 slip generation (optional)

Need help? Contact our support team here.